OLYMPIA, WA – Washington State Insurance Commissioner Mike Kreidler issued fines in November totaling $367,500 against insurance companies, producers, brokers, and individuals who violated state insurance laws and regulations. The office oversees the State’s insurance industry to ensure that state laws are followed. Since 2001, Kreidler has assessed more than $37 million in fines, which are directed to the State’s general fund to pay for state services.

From Insurance Commissioner’s Office:

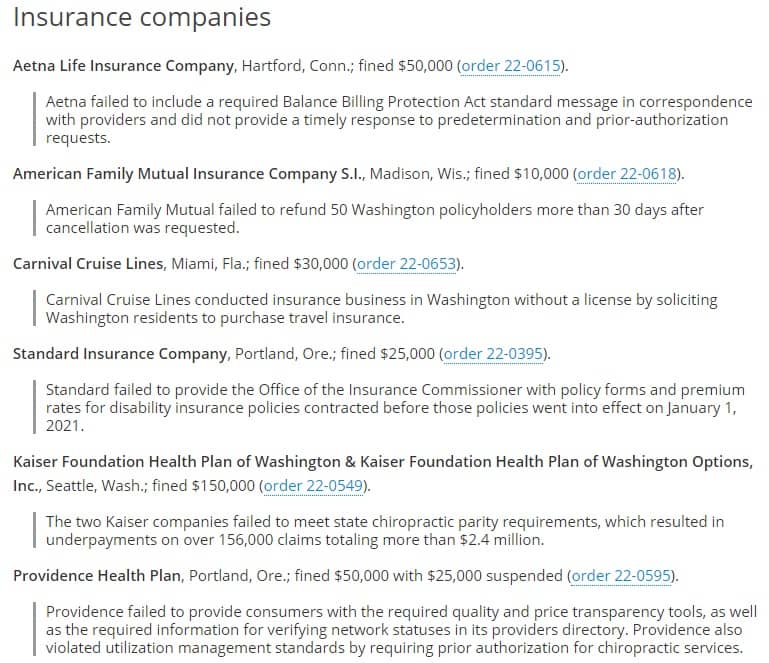

Insurance companies

Aetna Life Insurance Company, Hartford, Conn.; fined $50,000 (order 22-0615).

- Aetna failed to include a required Balance Billing Protection Act standard message in correspondence with providers and did not provide a timely response to predetermination and prior-authorization requests.

American Family Mutual Insurance Company S.I., Madison, Wis.; fined $10,000 (order 22-0618).

- American Family Mutual failed to refund 50 Washington policyholders more than 30 days after cancellation was requested.

Carnival Cruise Lines, Miami, Fla.; fined $30,000 (order 22-0653).

- Carnival Cruise Lines conducted insurance business in Washington without a license by soliciting Washington residents to purchase travel insurance.

Standard Insurance Company, Portland, Ore.; fined $25,000 (order 22-0395).

- Standard failed to provide the Office of the Insurance Commissioner with policy forms and premium rates for disability insurance policies contracted before those policies went into effect on January 1, 2021.

Kaiser Foundation Health Plan of Washington & Kaiser Foundation Health Plan of Washington Options, Inc., Seattle, Wash.; fined $150,000 (order 22-0549).

- The two Kaiser companies failed to meet state chiropractic parity requirements, which resulted in underpayments on over 156,000 claims totaling more than $2.4 million.

Providence Health Plan, Portland, Ore.; fined $50,000 with $25,000 suspended (order 22-0595).

- Providence failed to provide consumers with the required quality and price transparency tools, as well as the required information for verifying network statuses in its providers directory. Providence also violated utilization management standards by requiring prior authorization for chiropractic services.

Unauthorized & unlicensed insurance

American Partnership Group LP, Georgia; fined $50,000 with $25,000 suspended (order 22-0106).

Data Partnership Group LP, Georgia; fined $25,000 with $12,500 suspended (order 22-0107).

- APG and DPG were fined for transacting insurance business without a certificate of authority and acting as unauthorized insurers. APG had one consumer in Washington state, and DPG had two, as of March 2021.

FlyHomes Closing, LLC, Bothell, Wash.; fined $30,000 (order 22-0419).

- FlyHomes was fined for selling, soliciting, or negotiating insurance without an active title license. FlyHomes’ title license expired November 19, 2020 and was not reinstated until October 11, 2021. During that time, FlyHomes reported opening 143 transactions that were ultimately concluded and earning $241,561.89 in net commissions. However, overall, the agency sustained a business loss because of its license lapse.

Producers & brokers

- Berg Benefits, Inc., Tacoma, Wash.; fined $1,000 (order 22-0556). Berg failed to transfer 18 clients’ policies after the clients signed letters asking for their policies to be transferred.

- Dana Treadwell; fined $1,000 (order 22-0605). Treadwell acted as an unlicensed independent adjuster.

- Aon Risk Insurance Services West Inc., Lincolnshire, Ill.; fined $1,000 (order 22-0654).

- Supple Merrill & Driscoll, Inc., Pasadena, Calif.; fined $500 (order 22-0657).

- National Discount Cruise Company, Allentown, Penn., fined $500 (order 22-0656).

- Jacquelyn Sarah Nash, Boerne, Texas; fined $500 (order 22-0648).

- Pivot True Health, Washington, Utah; fined $500 (order 22-0650).

- Ivy Victoria Lease, Philadelphia, Penn.; fined $250 (order 22-0662).

- Nyeesha Riley, Seattle, Wash.; fined $250 (order 22-0651).

- John James Forster, Richardson, Texas; fined $250 (order 22-0631).

- Jack Philip Hanks, Scottsdale, Ariz.; fined $250 (order 22-0633).

- United Aline Co., Ltd., Great Neck, NY; fined $500 (order 22-0644).

- BrightClaim LLC, Sandy Springs, Ga.; fined $250 (order 22-0625).

- LCM Holdings LLC, Orlando, Fla.; fined $250 (order 22-0647).

- Eva Marie Hambsch, Westport, Conn.; fined $250 (order 22-0489).

- Stuckey Insurance, Phoenix, Ariz.; fined $250 (order 22-0610).

- Geico General Insurance Company, Omaha, Neb.; fined $250 (order 22-0589).

- Cassandra Evans, Memphis, Tenn.; fined $250 (order 22-0436).

- Custard Insurance Adjusters Inc., Norcross, Ga.; fined $250 (order 22-0626).

- Multi-State Insurance Services LLC, Huntington Beach, Calif.; fined $250 (order 22-0620).

- Brian Albee, Marietta, Ga.; fined $250 (order 22-0624).

- SureCo Insurance Solutions LLC, Santa Ana, Calif.; fined $250 (order 22-0640).

- Maria Candice Ann Santos Rezzo, Norfolk, Va.; fined $500 (order 22-0475).

- Julliette Torres, Cape Coral, Fla.; fined $250 (order 22-0627).

- Kouame N’Dri, Charlotte, N.C.; fined $250 (order 22-0664).

About the Office

Kreidler’s office oversees Washington’s insurance industry to ensure that individuals, companies, agents and brokers follow state laws. Since 2001, Kreidler has assessed more than $37 million in fines, which are directed to the state’s general fund to pay for state services.

The Office of the Insurance Commissioner publishes disciplinary orders against companies, agents and brokers. Consumers can also look up complaints against insurance companies.

For an insurance question or complaint, contact Kreidler’s consumer advocates online or by phone at 800-562-6900.