OLYMPIA, WA – Washington State House Democrats have introduced proposed revenue legislation for the 2025-27 operating budget. The state is facing a budget shortfall of $15 billion, with several billion more needed to address school funding shortages.

Over the past decade, nearly a million more people have made Washington their home, driving up demand for vital services like schools, housing, health care, and child care. These essential services are disproportionately funded by working families, while the ultra-wealthy pay the least under Washington’s regressive tax system.

“Washington’s tax system, built nearly a century ago, is failing to meet the needs of our rapidly growing state and is increasing income inequality,” according to Representative April Berg (D-Mill Creek), Chair of the House Finance Committee. “The gaps between working families and the gains by the wealthiest in our state have resulted in not enough funding for our schools, a safety net that is at risk every time revenue collection drops or costs go up, and average Washington residents struggling to make ends meet. That’s why our budget discussions over these last few months have always included determining savings and finding efficiencies within the budget, as well as new revenue opportunities.”

From House Democrats:

“Thank you to Rep. Berg and her team for weighing all the options to help us close the gap in our budget deficit. Budget writers have spent the last 3 months scouring the budget for where we can make changes. Monday we will share our budget proposal, but we would be in a far worse situation if we did not have these revenue options,” said Rep. Timm Ormsby (D-Spokane), chair of the Appropriations Committee.

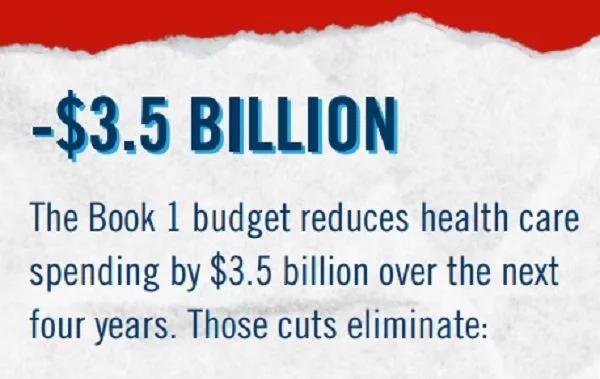

Last month, House Democrats highlighted the devastating impacts of the example all cuts, no revenue budget former Governor Jay Inslee was required to prepare, called the “Book 1” Budget.

The revenue proposals introduced by the House Democrats include the following:

Property Tax Fairness Through Financial Intangible Assets Tax

A Financial Intangible Assets Tax (FIT), sponsored by Rep. April Berg (D- Mill Creek), imposes a property tax of $8 on every $1000 of assessed value on certain financial intangible assets, such as stocks, bonds, mutual funds, and index funds, with the first $50 million in assessed value exempt from the tax to best ensure tax fairness. Other exemptions include pensions, retirement accounts, and education savings accounts. The Department of Revenue estimates around 4,300 wealthy Washingtonians will pay the tax, generating approximately $2 billion per year, beginning in fiscal year 2027, which will be dedicated to the Education Legacy Trust Account to support Washington families and fund vital investments in K-12 schools.

“The average Washington family’s primary asset and wealth building tool is their home,” said Berg. “For generations, Washingtonians have paid annual taxes on their homes and land, and this bill helps bring equity to our state’s tax code by taxing the tools by which millionaires and billionaires build wealth, ensuring the wealthiest Washingtonians share in the responsibility of funding our paramount duty to provide a quality education for our state’s students.”

Increasing State and Local Flexibility to Fund Schools and Public Safety

A bill to invest in the state’s paramount duty to fund K-12 education and build strong and safe communities, sponsored by Rep. Steve Bergquist (D-Renton), would modify the state and local property tax authority and adjust the school funding formula. The bill maintains the 1 percent cap on property tax growth but allows for increases based on inflation and population changes, not to exceed 3 percent. The bill also adjusts levy equalization methods to ensure equitable funding for historically underinvested areas of our state, including rural school districts, mitigating widening funding gaps between schools. The Department of Revenue estimates the change will increase funding for state investment in K-12 schools by $50 million in fiscal year 2026 and $150 million in fiscal year 2027.

“Every member of the Legislature has heard about our school districts struggling with enrollment and funding issues. Needs continue to grow, and it is the state’s paramount duty to meet that need. Capping property tax at one percent hamstrings our schools, our public safety, and our response to behavioral health needs. It’s time for that to end so that we can meet our school funding obligations and give local governments the funding they need to build resilient communities,” said Bergquist.

Surcharge on High-Grossing Corporations and Financial Institutions

To fund critical programs that benefit Washington’s working families, Majority Leader Rep. Joe Fitzgibbon (D-West Seattle) introduced legislation imposing a 1% Business & Occupation (B&O) tax surcharge on businesses with taxable income over $250 million. This modest surcharge only applies to the wealthiest corporations—approximately 400 businesses statewide—ensuring that small businesses and working families remain unaffected. The bill also includes an increase to the surcharge on specified financial institutions (approximately 200) with annual net income of $1 billion or more from 1.2% to 1.9%.

Under this proposal, Washington will generate nearly $600 million in fiscal year 2026 and nearly $2 billion in fiscal year 2027, ensuring a revenue stream will shield essential public services from economic downturns and political uncertainty, creating a more stable and sustainable financial future for the state.

“Washington’s highest grossing businesses benefit from a strong K-12 education system, higher education system, and social safety net, as do all Washingtonians,” said Fitzgibbon. “By applying a surcharge on the Business & Occupation Taxes the biggest businesses in our state pay, we can protect Washingtonians from harmful cuts to education, public safety, and the safety net and invest in critical public services that keep people healthy and support our economic future.”

“Washington’s been on the path to significant tax reform for decades, because we know that the current system is not performing well for the people of our state,” said Berg. “By leading with Democratic values and equity, we can ensure that every Washingtonian can succeed. We can both build a strong economy and relieve economic pressures on lower- and middle-income families by better aligning our tax code.”

The operating budget funded by these revenue proposals will be released on Monday, March 24. The House and Senate must negotiate and agree on a final budget and revenue plan by the end of the legislative session, on April 27.