OLYMPIA, WA – The Washington State Economic and Revenue Forecast Council says job growth in the state has been stronger than expected in the four months since its February forecast. However, historical revisions have lowered the level of employment. In addition, Major General Fund-State revenue collections for the April 11th – May 10th collection period came in $114.0 million (4.6%) lower than forecasted in February after last month’s $82.9 million surplus. Officials say $42.7 million of this month’s shortfall came from property tax collections. This shortfall likely indicates a change in the pattern of payments ahead of the spring due date rather than expected lower collections and will, therefore, probably be reversed next month.

From the FERC:

Total seasonally adjusted nonfarm payroll employment increased 24,800 since December, which was 10,800 more than the 13,900 increase expected in the forecast. The construction sector increased by 4,700 jobs while manufacturing employment increased by 2,000 in the fourmonth period. Education and health services had the largest increase in the private service sector, gaining 6,500 jobs since December. The largest decline was in employment services with a loss of 5,400 jobs. Government employment increased by 8,300 primarily due to a 5,100 job gain in state government education. The combination of downward revisions to history and stronger than expected job growth have resulted in the level of employment being 12,200 lower than expected in the February forecast.

Washington’s unemployment rate has been trending upward. The unemployment rate remained at 4.8% in April from the month before, but up from a recent trough of 3.8% in June 2023. Labor force participation declined to 63.8% in April from 63.9% the month before and is down from the recent peak of 64.5% in June 2023.

Washington initial claims for unemployment insurance increased sharply in the most recent week. The seasonally adjusted number of initial claims increased to 7,170 in the week ending May 4th from 5,806 in the prior week. The fourweek moving average has increased in each of the past four weeks to 6,161 from a recent trough of 5,604 in the week ending April 6th.

Washington housing construction rebounded in the final month of the first quarter of 2024. A total of 38,000 units (SAAR) were permitted in first quarter, up from 34,500 units (SAAR) in the fourth quarter. The increase in the first quarter was due to 47,400 units (SAAR) being permitted in March. This increase was primarily due to a large number of apartment buildings being permitted. Permits in the first quarter consisted of 20,600 single-family units and 17,400 multifamily units. The February forecast assumed 38,700 units for the first quarter, consisting of 21,200 single-family units and 17,500 multifamily units.

The S&P CoreLogic Case-Shiller Seattle home price index increased 1.1% in February following a decline of 0.1% the month before. Home prices in Seattle are up 7.1% since last year. In comparison, the composite-20 index grew 0.6% in February and 0.2% in January. The composite-20 index was up 7.3% year-over-year in February.

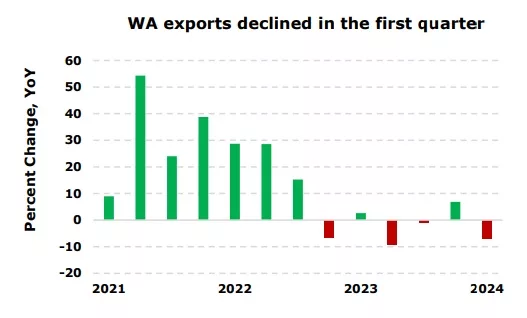

Washington exports declined 7.0% from the first quarter of 2023 to the first quarter of 2024 (see figure). The decline was fueled by a 23.0% decrease in transportation equipment exports.

Agricultural exports declined 6.0% over the year, the sixth consecutive decline. Excluding transportation equipment and agricultural products, Washington exports increased 5.3% year-over-year in the first quarter of 2024.

Washington car and truck sales appear to have leveled off. The seasonally adjusted number of new vehicle registrations declined 3.1% in April to 270,500 (SAAR). Passenger car registrations declined 3.1% while light truck registrations declined 2.8%. The number of total registrations remained up 0.7% over the year in April.

Major General Fund-State (GF-S) revenue collections for the April 11 – May 10, 2024 collection period came in $114.0 million (4.6%) lower than forecasted in February after last month’s $82.9 million surplus. $42.7 million of this month’s shortfall came from property tax collections. This shortfall is likely due to a change in the pattern of payments ahead of the spring due date rather than expected lower collections and will therefore probably be reversed next month. Cumulatively, tracked collections are now $60.6 million (1.0%) lower than forecasted.

Revenue Act collections for the current period came in $105.7 million (5.1%) lower than forecasted in February. Cumulatively, collections are now $51.4 million (0.9%) lower than forecasted.

More information HERE.